Anticipated Increase in 2024-2030 Assets

By Stephanie A. Walker Stradford and Eric Stradford, U.S. Marine Corps, Retired

AMWS, April 27, 2024, Atlanta – Generation Alpha today

declared, #NoPoverty2030 as their personal, possible mission. Representing a “Whole

of Government” approach to economic security, 27 of 100 new “secret

millionaires” planted their Money-n-the-Bank

vision into a replicable reparations trust. One Gen Alpha winner responded to Benjamin

Franklin’s “Time

is Money” aphorism with “bending time” as a whole new way of making their

money work for them.

Each year since 9-11-2006, Youth Achievers USA Institute

(YouthUSA), a Delaware incorporated 501c3 public charity has reported to the

U.S. Internal Revenue Service (IRS) on its program accomplishments, along with

money it received and purposes for which charitable revenue was used. Frequently Asked Questions (FAQs) about

YouthUSA center on its financial assets.

Based on Money-n-the-Bank

responses from two Sub-Saharan African countries, YouthUSA anticipates an increase

in its charitable revenue between 2024 and 2030. Budget projections rely on

needs assessed in cooperation with “Generation Alpha Secret Millionaires.”

Youth Achievers USA Institute 2023 Program

Accomplishments

On the 2022 IRS 990-PF, one foundation reported

$23,221,054,512 (billion) in contributions, gifts, grants, etc. Interest on savings and temporary cash

investments totaled $13,436,826 (million).

The foundation granted $6,806,925,000 (billion) to a single public

charity and treated a -$680,692,500 (million) portion of grants paid as a

distribution of corpus under treasury

Reg. 53.4942(A)3 for a total contribution of $6,126, 232,500 (billion).

Youth

Achievers USA Institute (YouthUSA), a 501c3 public charity committed to

United Nations Sustainable Development Goals 1 (No Poverty) and 17

(Partnerships), seeks to demonstrate atonement for the neglect of children

through a mentor-protégé relationship with the model foundation. The U.S. charity proposes to #BeTheBridge

between good intentions and sustainable goals.

Historically, YouthUSA has filed IRS 990-EZ since its incorporation of

9-11-2006. The corporate logic has been to learn to drive the bus empty before

loading it with children. The charity

has never secured 100% funding for its projected $500,000 annual budget because

the assessment reflected a need for more time at less expense.

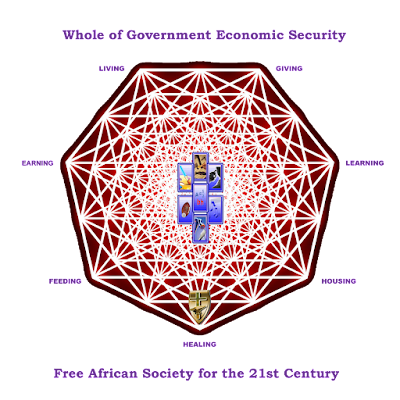

In 2023, YouthUSA funded its FREE

AFRICAN SOCIETY (FAS2) brand with a VISION OF THE FUTURE. The historic

brand was allegedly acquired from trustees with a “Widow’s Mite.” The late Evelyn

Walker Armstrong, MLS, reinvested family values to seed a modest Charitable

Remainder Trust. News reports on the

loss of a nearly $100

million pension fund for retired ministers of the African Methodist

Episcopal Church diverted church priorities from pressing global issues such as

SDG 1, No Poverty. The Historical Black

Church and its corporation has been challenged to declare #NoPoverty2030

#MissionPossible in the name of #BlackJesus as its faith contribution toward HEALING

THE SOUL OF AMERICA. From a YouthUSA

perspective, the problem presents an immediate opportunity for Generations A

and Z to learn to do better.

Program 1

THE ANNUAL YOUTH ACHIEVEMENT AWARDS (AYAA) is a

proprietary circular capacity building program created by YouthUSA Founder

Stephanie A. Walker Stradford. The

program uses Microsoft Sharepoint collaboration software to sustain its

charitable operations. In 2023, YouthUSA

sustained its support for United Nations Sustainable Development Goal #1

through its promotion of the #NoPoverty2030 social media hashtag. YouthUSA

embraces the corporate motto, I believe I can achieve whatever I believe I can

achieve. This motto promotes time as the single most valuable asset in

achieving the YouthUSA and United Nations Sustainable Development Goals. Our

2023 activities responded to a needs assessment among potential economic

beneficiaries from Generations Z and A. “We NEED more money!” they said. Global pandemic from COVID-19 drastically

challenged our efforts to achieve #NoPoverty2030. For the first time in

YouthUSA history, the organization reached out to potential international partners

to provide Learn-2-Earn (L2E) technical assistance in Lesotho, Africa. One LEARN-2-EARN grantee received

unrestricted capacity building grant funding towards future World Bank projects.

Program 2

THE AMERICAN MENTOR WIRE SERVICE (AMWS) is a

communications asset of Youth Achievers USA Institute. AMWS operates as a news

service via Internet. Production of eighteen (18) YouTube videos and seventeen

17 Blog posts augmented Facebook, Twitter, and Linked-In social/business

networking. AMWS 2023 program spending supported Black Wall Street support for

#BlackLivesMatter. Targeted social media advocacy to The White House Domestic

Policy Advisor, The Obama Foundation, The U.S. Black Chambers of Commerce, The African

Methodist Episcopal Church and the Holy See promotes a vision for Economic

Inclusion as a pathway for 2.4 billion believers to engage in achieving

#NoPoverty2030.

Program 3

The J.D. and Laurena Walker Fund (JDLWF) serves as a

development program, identifying SUFICIENT PROVISION for COMMON VISION. The

fund includes $10,000 at-risk investment at Chicago's Ariel Investments and

$100,000 in FDIC Insured bank assets toward an endowment for sustaining

#NoPoverty2030. A replicable $100 million endowment is demonstrated by assessed

needs of 100 Generation Alpha beneficiaries, each with a projected $1 million

Whole Village Trust, economically including 20 caring adults, each with a

minimum net worth of $50,000 by June 9, 2030. JDLW 2023 program spending of

$3042 supported cash and hardware grants. The program invested in development

of virtual (Internet sites) and real

property (GrandMentors’ House), compounding value to inherited resources from

the J.D. and Laurena Walker Family. In 1996, Laurena Puriefoy Walker invested

faith in the YouthUSA community as its first Grand Mentor. Youth Achievers USA Institute

engages current and new directors in codifying this edification for elders in

the YouthUSA Corporate Village. #PlayTheGame

is under development as a process for inclusion in shared ownership of The

New Stradford Hotel Upon Black Wall Street. Outcomes are yet to be

determined.

Program 4

TheEnterpriZe Social Enterprise Program - The program modeled a U.S. Small Business Administration Certified veteran-owned limited liability company (LLC). Equity Members assessed 100,000 LLC Member Units at $10/par. Valuation is based on accounts receivable from a $10 m USD Sole Source Federal contract. The LLC contracted with YouthUSA and small trust clients to develop shared-owner employment opportunities. Assessing the need for an Internet presence to support global social enterprise development, YouthUSA established www.FreeAfricanSociety.net and www.FAS2.net . The sponsored site integrates multimedia blogs with Artificial Intelligence to support multi-year engagement for living generations. Crowdfunding strategies are deployed within capacity building tools to ensure inclusion of Generation Alpha Secret Millionaires. The program incubates veteran and historically disadvantaged small business partners in making business as usual a practice of the past. Outcomes include social enterprise PROVISION for UN SDG 1 #NoPoverty2030.